Afterpay - Revolutionizing the Payment Landscape

Author: John Smith Date Posted:20 September 2018

In the present day, Afterpay is a game changer for shoppers looking for innovative and affordable ways of paying for goods and services.

Immensely popular in Australia, Choice reports that as of February 2018, more than 1.5 million consumers were using this payment system. This amounted to a staggering $1.5 billion in payments across more than 12,000 outlets.

This is a refreshing change as Australians have traditionally reached for one of two things in the checkout process - card or cash. According to RBA statistics from 2016, 52% of all payments in Australia were made with a debit or credit card and 37% were made using cash.

Launched in 2015, Afterpay has stirred a revolution in Australia, with 2.2 million people having made an Afterpay transaction as of July 2018. Available in around 10,000 individual shops throughout Australia and New Zealand, this service is now available almost everywhere.

Our blog this week takes a look at this payment system, diving into how it works and its exceptional benefits. Continue reading for more!

What is Afterpay?

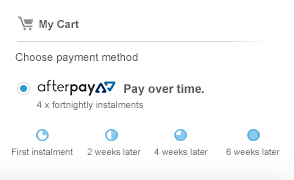

Afterpay is a buy now, pay later system that consumers can choose when they check out a product online or in-store. It allows them to pay off the item in fortnightly installments and typically carries no interest for each deposit.

While Afterpay is a little bit like a lay-by, in this case, you get to take your purchases home before you’ve finished paying for them. It’s now a payment option you can find at many of your favorite online stores.

If you choose to pay with Afterpay, your purchases will be posted to you as normal - the only difference is that you get eight weeks to pay off the balance cost.

What makes Afterpay great is that it’s all automatic. Once you make an account, the payments are deducted from your credit card or bank account on a nominated day. The service sends you text messages before funds are withdrawn and, unlike a credit card, you don’t have to worry about making payments - Afterpay does it for you, automatically.

How does it work?

This service is offered as a payment method in the checkout section of many stores. If you are using it for the first time, you’ll be asked to make an account and give your phone, bank, and address details. If you already have an account, you’ll just be asked to sign in.

Once you’ve used this service, there’s no going back.

For repeat users, immediate payments aren’t necessary; each installment is automatically deducted in four equal amounts every two weeks. If you’re a first-timer, however, you will be required to make one of four payments immediately and then one every two weeks thereafter.

The marvels of Afterpay

With a wide range of retailers now offering this service and with zero interest involved, Afterpay makes for a pretty enticing payment option. Some of its benefits include:

Immediate use

Customers are able to quickly set up and use their Afterpay account straight away, rather than go through a lengthy application process.

Seamless integration within a store

Afterpay can be fully integrated into the checkout system of an online store, making it a convenient and user-friendly payment option.

Fee and interest-free terms

By using Afterpay, you don’t have to pay any interest on your installments This way, you avoid the hefty interest and application fees that are associated with money lending options.

Afterpay prides itself on being free for all customers to use, with the only cost incurred is the price of your product.

The refund process stays the same

If you’re worried that adding Afterpay to the mix might interfere with your ability to get an easy refund, don’t stress.

You can still claim a refund for purchases made with this service, provided that it’s in line with a store’s refund policy.

Good alternative to using a credit card

If you usually use your credit card to make purchases you wouldn’t otherwise be able to afford, switching to Afterpay for retail spending may be a good option as this prevents you from spending money you don’t have.

Who can use Afterpay?

Since Afterpay isn’t a loan company or credit union, you don’t need to be approved for an account like you would for a credit card or personal loan.

Here, eligibility criteria only include that you must be 18 or older and have a credit or debit card you can link your account to.

What can you buy using Afterpay?

The sky’s the limit when it comes to utilizing this revolutionary payment option.

Research studies have shown that 56% of buyers used Afterpay to purchase luxury items like clothing, pet accessories, and car accessories. A further 36% used the service to purchase items like new beds, appliances, and other functional household items, while food items and other necessities amounted to 8%.

Visit EXTG today to capitalize on Afterpay and live a life replete with affordable luxury.